You’re not running a boarding house; you’re simply letting your adult child, elderly parent, or cousin down on their luck live in a property you own. It feels awkward to ask them to sign anything. “We’ll just sort it out as we go”, you think.

But then the questions creep in:

- Will they pay anything for rent or bills?

- Are they responsible if the property is damaged?

- Can they refuse to leave when you want to sell or move someone else in?

If you’re relying on goodwill alone, you may be setting yourself (and your family member) up for a dispute. Even if everyone has the best intentions, expectations can become blurred, particularly over time or when financial pressures mount. One way to avoid this? Decide early whether the arrangement should be structured as a lease or a licence to occupy, and then document it appropriately.

What’s the difference?

The legal distinction between a lease and a licence matters because it affects:

- Whether your family member has enforceable legal rights to stay;

- What happens if the property is sold or you pass away; and

- How easily you can bring the arrangement to an end.

Here is what each means in simple terms:

A Lease

A lease is a formal agreement that gives the occupant exclusive possession of the property for a defined term (e.g. 6 or 12 months). Legally, it creates a proprietary interest, which means the occupant can enforce their right to stay even if the property changes hands.

Think of it like handing them the keys and saying: “This is your space. I can’t enter without your permission.”

A Licence to Occupy

A licence gives someone permission to use the property, but it doesn’t grant exclusive possession. It’s more limited, and the rights are personal, not proprietary. The occupier can be asked to leave at short notice (depending on the licence terms) and cannot stop you from entering.

Think of it like saying: “You’re welcome to stay, but it’s still my space.”

Why it matters in family arrangements

When it’s family, we tend to be more relaxed. But this is where problems start.

Let’s say your sister moves into your investment property to “get back on her feet”. No rent is paid, and there is no written agreement. Three years later, you want to sell but she refuses to leave, claiming you promised she could stay indefinitely. Now what?

If there is no clear agreement, a court may have to decide:

- Was this a lease (with exclusive rights and protections)?

- A licence (with limited rights, easily revoked)? or

- Something else altogether, like a constructive trust claim based on a “promise”?

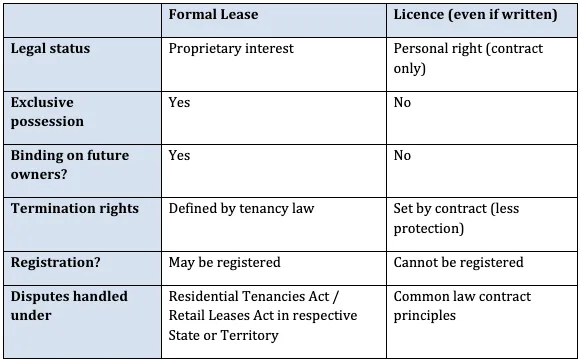

Formal Lease vs Licence: What protections do they offer?

Here is a handy table we have put together that provides points of general comparison between a lease and a licence.

If you need assistance in differentiating between a lease and licence to occupy, we can help. Call us on 1300 654 590 or email us.

Why labels aren’t enough

You can call your document a “licence”, but if it grants exclusive possession, a court may treat it as a lease. Conversely, calling something a “lease” does not automatically make it one if it does not meet the legal criteria.

What courts look at is substance over form:

- Did the occupant have exclusive control over the premises?

- Could the owner enter freely or make concurrent arrangements?

- What were the parties’ true intentions?

Which should you choose?

Deciding which document best suits your circumstances can be difficult. Here are some questions to guide you:

Do you want your family member to feel secure for a set period?: Use a lease, ideally with clear written terms.

Do you want flexibility to reclaim or repurpose the space on short notice?: A licence may suit better – but still put it in writing!

Are you worried about inadvertently creating a property right that binds future owners or executors?: Avoid a lease unless you are prepared for those consequences.

Are you concerned about Centrelink, tax or estate planning implications?: Speak to a lawyer. Both leases and licences can affect eligibility, deductions and asset classification.

How we can help

Letting family live in your property can be a generous and supportive decision, but don’t let it become a legal or emotional trap. The best arrangements are those where expectations are aligned and documented.

Whether you opt for a lease or a licence, what matters is that both parties understand their rights and obligations from the start. The right document, drafted carefully, can prevent the kind of painful disputes that ruin family ties. If you would like to speak to someone about the best way of providing accommodation for a family member, call us on 1300 654 590 or email us.

The information contained in this post is current at the date of editing – 10 September 2025.